Terms like ‘Impact Investment’ and ‘Social Impact’ are trending. While these terms have tremendous imaginative power, a clear and shared understanding of how purpose and profit intersect still eludes most.

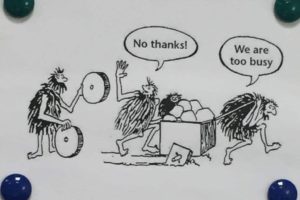

Those drawn to social impact-related endeavors typically arrive with different training and motivations. With that, the knowledge transfer from one group to the often faces challenges. Each group maintains its own language, secret handshakes, and initiation rites. Failure to appreciate what the other brings leads to missed opportunity.

“Impact investing appears to have been seduced by a convenient narrative…Impact investing was originally created to improve the lives of others; that impact investing could also deliver financial returns to investors was a means to that end. According to the prevailing view, the achievement of both social impact and market-rate financial returns is the norm—not the exception.”

– “Marginalized Returns,” Stanford Social Innovation Review, Mara Bolis and Chris West

Balancing Purpose and Profit in Education

I watched the dynamic play out in the cradle of all social impact, purpose-driven sectors, education. For most of the last decade, I ran a B2B company whose core asset uniquely positioned us to work hand-in-hand with CEOs and senior executives of nearly 200 companies across the funding and maturity spectrum. Below, I offer a few of my impressions of how these two groups interact:

Venture Capital & Private Equity

Venture Capital & Private Equity

- The investor community’s proficiency level in K-12 education has increased.

- However, the driving investment criteria continues to leave out a significant portion of the current or future realistic performance of most K-12 companies.

- Emerging funds have an explicit focus on education. The move reflects an appreciation of core K-12 values such as empathy, mentorship, and time.

- Increased investor activity in the last three years reveal an appetite for roll-up/consolidation.*

K-12 Education Company

- The K-12 education company profile has become more sophisticated over the past ten years.

- Still, former teachers, lead a large portion of K-12 companies. The group possesses deep market knowledge and is mission driven. The business savvy and understanding of how to effectively commercialize product, however, remains inconsistent.

- More and more (sharp) technologists have joined the industry. Some launch start-ups. Their introduction presence distracts some and raises the bar for others. The learning curve of market dynamics slows relationship development – a key factor in the field.

- Yet, the established players maintain ownership of the channel – a critical vehicle for institutional sales success.

- Investors see a more familiar target profile with the technology start-ups and in larger ERP-like data systems.

- Unfortunately, many K-12 companies struggle to realize that their product must solve a real problem. Investors lose patience.

Overall, K-12 education provides an poster child opportunity for Social Impact. Education businesses generate tested, transformational ideas, that often remain trapped. Investors have access to transformative capital and networks, When connected, everyone stands to benefit exponentially.

* Perhaps these moves fall under the Bolis and West definition of ‘Impact Investment,’ but suspicions of the investor’s intent from within the market persist.

Are you wrestling with the decisions that will shape your company’s growth and impact? Let’s chat.